Gold has started 2016 on an impressive note and gold bulls have been smiling to the banks since the markets opened for trading this year. Gold recorded a remarkable feat during the first quarter when it delivered 17% gains to become the best-performing commodity on the market – Silver seems to be ahead at the moment though. The bullish tailwinds that the bullion enjoyed in 2016 has given the yellow metal the best start in almost a decade but an excellent start doesn’t always guarantee a perfect ending.

Gold has been on a blast lately

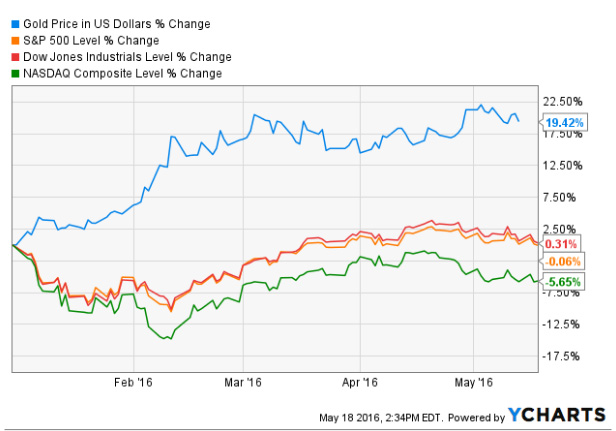

The uptrend in gold caused U.S. equities to suffer for much of the first quarter ; of course, it can be reasonably argued that equities have generally been having a tough time in the global markets and not in the U.S. markets alone. Equities have suffered while gold investors have been rewarded as seen in the chart below.

In the year-to-date period, you’ll notice that gold has gained 19.24%; in contrast, the S&P 500 has lost 0.06% in the same period. In the same period, the Dow Jones Industrials has only managed to gain 0.31% and the NASDAQ Composite has lost a massive 5.65%. Nonetheless, the fact that gold has outperformed equities in the year-to-date period doesn’t necessarily mean that gold investors are better off than equity investors.

However, folks who trade in derivatives such as options and futures might be better served than people who are investing in the underlying assets. If you are not conversant with the derivatives market, you might want to take time to learn the introduction to binary options trading in order to increase your odds of winning irrespective of what the general equity market does.

Gold crashes ahead of Fed minutes

Gold might have fared better than equities in the last couple of months; yet, the likelihood that the yellow metal will outperform equities at the end of the year can be contested. To start with, gold is crashing today after the U.S. Federal Reserve released the minutes of its April policy meeting. The tone of the minute sounded hawkish and a hawkish position by the Fed often exerts downward pressure on gold.

The Fed hinted that it might go ahead to raise interest rates in June and some Fed officials were vocal in their support of a June rate hike. Atlanta Fed president Dennis Lockart and San Francisco Fed president John Williams both have said that they will support a move to raise interest rates in June. In fact, it is quite possible that the Fed will raise interest rates 3 times this year.

The Fed had made it clear that it has plans to raise interest rates twice this year but the rate hike was contingent on the quick recovery in the U.S. economy. The fact that the Fed is now moving towards a rate hike suggests that the U.S economy is recovering and investors have fewer incentives to put money in the safe-haven status of gold if the economy is healthy.

More so, the latest economic data confirms the recovery in the U.S. economy. For instance, the Consumer Price Index, (CPI) climbed more than expected in April. The CPI climbed 0.4% over the previous month and it gained 1.1% year-over-year to mark the biggest gains since February 2013.

The increase in bearish sentiment has weighed gold down and the yellow metal is recording losses in today’s session. Today, spot gold was down to a session low of $1,266.56 an ounce and it is on track to close with a 0.9% decline at $1,268.56 Gold for June delivery was trading around $1,274.40 an ounce to mark a $2.50, or 0.2% drop from Tuesday’s finish.

MKS SA head of trading Afshin Nabavi notes that “there is always some profit taking coming in the market between $1,285 and $1,295, while buying occurs between $1,260 and $1,270… Only if physical demand comes in, we are likely to see prices above $1,300.”

Sources: wsj.com / 10trade.com / reuters.com

Related Posts

« Forex Trading with Bitcoin Copy trading sees rapid growth »