Recent years have seen the rapid growth of so-called copy trading, a method of social-network based investing.

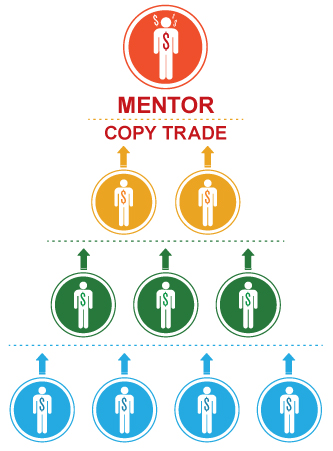

Copy-trading platforms are social media networks that allow users to view each other’s investment moves, seeing what shares and currencies they have bought and sold and what gains and losses they have made. Members can then copy the decisions of others.

When you find a trader who appears successful, you can allocate a portion of your money to be automatically invested the same way. Or, users can simply follow other traders and receive alerts about moves they make, deciding on an individual basis if they want to copy the move.

The increase in copy trading goes along with the general rise of people taking investment decisions into their own hands.

A study by Aite Group showed that about one-quarter of American adults engaged in online trading of assets.

Now there are now at least 33 large social trading networks, many of which offer copy trading. Most of these cater to the European and Australian markets, with many based in London.

But platforms say copy trading has huge potential in Russia and China, two large markets. In these places, ordinary people, by following and copying established traders, will be able to tap into the once unfamiliar Western financial markets. The potential in Russia and China is “mind-blowing,” said Yoni Assia, CEO of eToro, one of the leading social investment and copy trading platforms that is expanding into these eastern markets.

Copy trading appeals to people because it is easily accessible, often on mobile device apps. It also usually has lower fees than most financial advisors, and seems more transparent because members can view fellow traders’ gains and losses. Because these platforms are often based on CFDs, or certificates for difference, a derivative based on the prices of equities and currencies, there are also more options for leveraging, meaning investors need to put up less money than if they were buying actual assets.

While some on Wall Street are skeptical of the platforms, other studies have shown that there are benefits to social trading, including copy trading. A recent MIT study showed that a proper balance between the so-called wisdom of the crowd and one’s own decision-making resulted in better investment results on copy-trading platforms.

At the same time copy-trading remains the turf of retail investors, more large financial institutions are incorporating big data and elements of social media into their investment services and strategies.

Sources: hbr.org / businessinsider.com / etoro.com / forbes.com

Related Posts

« Gold outperforms equities but the future is gloomy Fortune or destiny? 7 stories of big-time winners »