The world biggest investors were cautious in purchases and one remained committed in the fall of the S&P 500.

Some of the biggest investors in the world have been cautious in investments made in the third quarter. Purchases of new stocks were few and George Soros held a huge bet on the fall of the U.S. market, according to data from GuruFocus based on quarterly reports that large investors have to disclose to the U.S. financial regulator.

The man who became famous in the market with a speculative bet on the fall of the pound put a ‘put option‘ on an instrument that replicates the performance of the S&P 500 index in an estimated value of $ 470 million in the first half of the year. And in the third quarter kept this commitment of a price fall, in a time when many investors alert for the possibility of a speculative bubble due to the injection of billions of dollars of central banks in the financial system.

Despite this negative bet there were companies who deserved a bet from Soros last quarter. It was the case of Microsoft, who became the highest weight in the billionaire portfolio investment. Besides the technological company, Soros also invested in the largest generic manufacturer in the world, the Israeli Teva Pharmaceutical Industries, and the delivery and logistics company FedEx. Also John Paulson, who distinguished himself with the profits made during the subprime crisis made a strong bet at FedEx last quarter. Hedge fund manager has strengthened his position in Vodafone, which led to become listed as his third biggest investment.

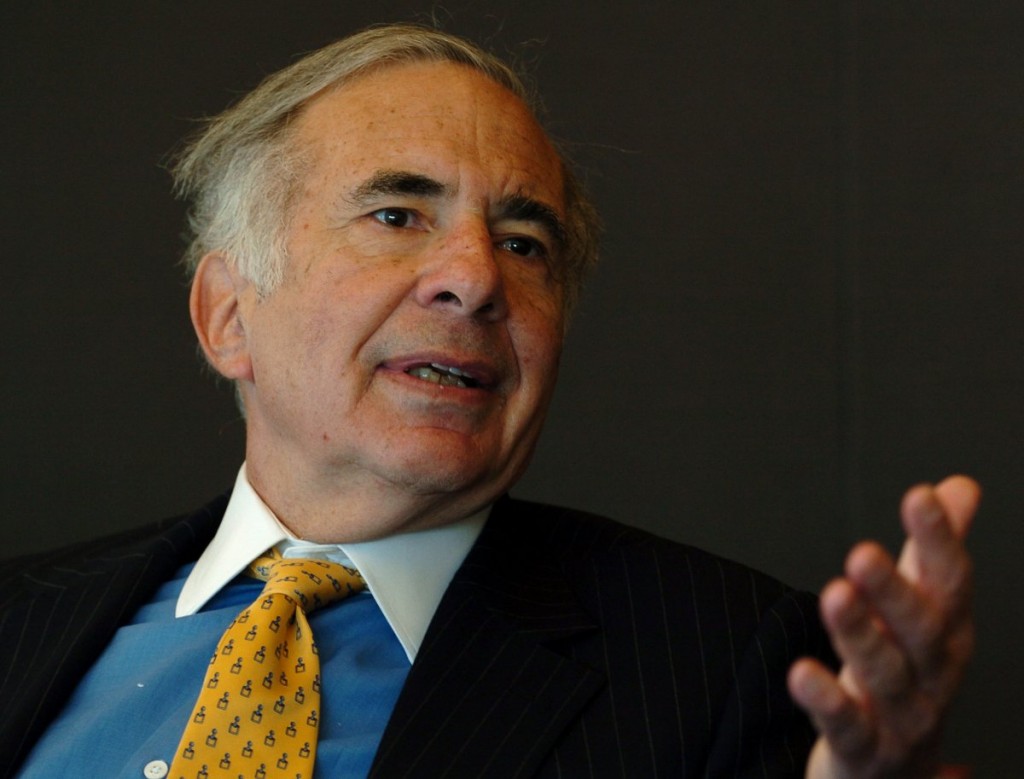

Another of the few big bets in the last quarter was taken by the investor Carl Icahn. This Wall Street legend opened a long high position at Apple, that took the iPhone manufacturer to become the third highest weight listed in his portfolio.

Warren Buffett was also measured in adding new companies to his giant investment portfolio. Just made ??one new purchase: shares of Exxon Mobil. But the size of the bet took the oil company to be the seventh highest weight in the portfolio of the Oracle of Omaha. And the Buffett choices continue to earn the trust of Bill Gates. Microsoft founder continued to strength in the last quarter the company of Buffett, Berkshire Hathaway, who won now greater importance in the investment portfolio of Gates. Bill Gates has already done shopping in Europe, such as the acquisition of shares in the Spanish FCC.

Warren Buffett

The Exxon Mobil was the biggest bet of the quarter.

Stocks with the highest weight in the portfolio are Wells Fargo, Coca-Cola, IBM, American Express and Procter & Gamble.

George Soros

Soros remained committed in the fall of the S&P 500 his largest position in the portfolio.

Besides this bet, biggest investments are in Microsoft, Herbalife and CharterCommunications.

John Paulson

The biggest shopping at Q3 were Vodafone, FedEx, and Time Warner.

Despite having been reducing the position, gold continues to have the greatest weight in the portfolio.

Bill Gates

Gates continued strengthening in Berkshire Hathaway.

Besides the Buffett ‘holding’, the largest positions are in Coca-Cola, McDonald’s and Caterpillar.

Carl Icahn

The strong manager bet was on Apple in the third quarter.

The largest investments are in Icahn Enterprises, CVR, Energy and Federal Mogul.

Related Posts

« Alan Greenspan rejects bubble on Wall Street Should you start investing in gold this new year? »