Modern businesses rely on the productivity of their workforce to be able to compete in their respective markets. Thus, it is essential to not only care for your employees, but to actively invest in their wellbeing. Employees can face challenges in their personal lives, not least of all is personal debt, and try as they might to avoid it, personal difficulties will sometimes follow them to work.

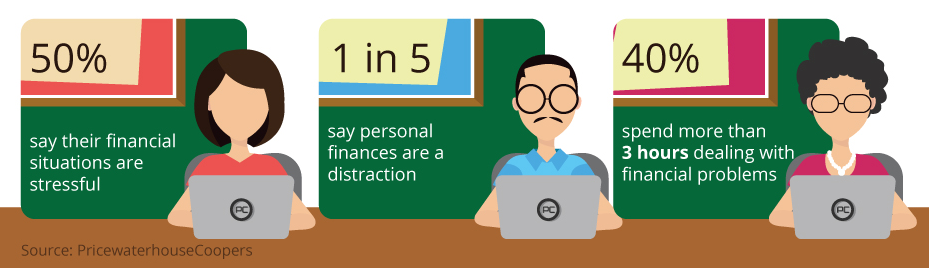

PricewaterhouseCoopers recent survey revealed that one in five employees have admitted that financial worries can be a distraction at work, with almost half admitting they have used company time to deal with personal financial issues. Sage reported that debt is so rampant in South Africa that 86% of the population must take out loans to afford daily expenses.

Fortunately, Sage have published advice on how businesses can best assist their employees out of debt, while improving their overall morale and productivity.

- Foster an open and caring environment

Employee wellbeing programmes allow staff the confidentiality and security to admit their issues and begin seeking help. Businesses that value openness and community support, providing an ear for personal issues, show their employees that they care about them, encouraging them to return the favour.

- Help employees realise the cause of the problem

Credit reports can be expensive if used multiple times with the same company, but more and more are offering a free report a year. Such reports not only give a detailed breakdown of where your credit is facing problems, but also provide easy to understand explanations as to why those problems exist.

- Identify the traps

Many people buy the promise that debt consolidation is the best way out of financial trouble. However, there are instances of people relaxing at the thought of only having one debt to pay, resulting in them falling back into bad habits. Worse still, while loan sharks might be able to offer a quick escape when the employee needs money right away, it is always safer to avoid loan companies with such high interest rates.

- Provide financial education

Providing access to education is the best way to empower employees to help themselves. Not only will this further confirm yourself as a business that cares, but offers the advice some employees desperately need.

There are numerous ways to provide this education, from in-house classes and sessions at new employee inductions, to employing a dedicated debt counsellor.

- Encourage professional counselling

Some financial challenges are too big for your own HR department to be able to solve, and aiding with counselling outside of work is likely to help allay employee worries. Numerous businesses that specialise in financial advice offer courses for employees to attend, with some being completely free.

Taking the time to help employees avoid financial difficulty not only secures your reputation as a business that cares for its employees, thus improving morale and appreciation among the workforce, it also ensures employees address their issues honestly so you can help refocus them faster on the work they have been hired to do.

Related Posts

« What Taxes Do You Need to Pay on Your Casino and Gambling Profits? The best casinos in Europe in 2017 »