Saving money these days has been a very complicated task. Many governments continue to implement austerity measures, reducing public investment, keeping an aggressive fiscal policy and definitely having tremendous difficulties growing. And who suffers the most with these policies are the middle classe and the poorest! Thus the best advice I can give you to save money is to reduce costs and to do so you have to be aware of products and services discounts, such as those of vouchersky.com.

But has also been a complex task to decide where to invest since the risk has been perceived in different ways. Investors have been more concerned with credit risk and less with volatility. Thus what better asset to avoid the credit risk than the investment funds! Let’s focus on them.

For now, emerging markets remain more profitable than the frontier markets, the new trend among fund managers.

India, Indonesia and Brazil are leading the gains in the world investment fund market. Which means, for now, emerging markets continue to provide better income to investors than the frontier markets. A discussion that has been installing itself in recent months, as economies like China, Brazil or Russia begin to slow down, and managers seek alternatives for growth.

Emerging markets may be defined as those with financial and capital markets already relatively developed and with good levels of liquidity, but whose income levels ‘per capita’ did not yet reach the countries of North America and Europe. While frontier markets have capital markets relatively new and underdeveloped.

Rami Sidani, fund manager of Schroder Frontier Markets Equity, at the end of 2013 explained the rationale behind this investment: “The frontier markets offer great investment opportunities, because they are not yet well known and hence are not much explored, but have great growth prospects for the next five or six years.”

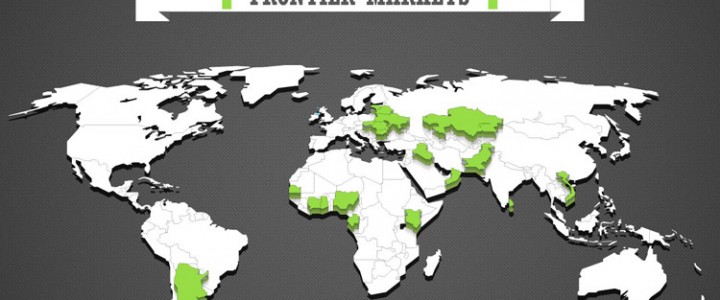

“These are markets that grow at an average annual rate of 6%??, which control a significant percentage of the planet’s natural resources and have a very young population, which is positive for economic growth and consumption growth.” This definition includes 25 countries in Asia, Eastern Europe, Africa, Latin America and Middle East. In other words, after the famous BRIC – Brazil, Russia, India and China – the frontier markets appear to be the new trend but for now the classics emerging continue to be more profitable.

Until August, Fidelity India Focus on euro, yielded YTD 39.8%, while Fidelity Indonesia Fund earned 29.3%. Both funds have a high risk profile, investing almost all capital in stocks with a preference for small and mid caps. In third and fourth are the Schroder Middle East and the Schroder Frontier Markets Equity, with gains of 28.3% and 24.9%, respectively.

Related Posts

« Bill Gross swaps Pimco for Janus The basics requirements associated with becoming a landlord »