In a time where the news is filled with distressing stories about social issues and environmental damage, there has never been a more important time for individuals and businesses to take steps to make positive change. One of the most effective ways of doing this is through something known as impact investing.

What is Impact Investing?

Impact investing is an investment made into a business, organization or fund with the goal of generating positive social and/or environmental impact in addition to financial return. This provides capital to address many of the most pressing matters affecting the globe today. Impact investments often aid with sustainable agriculture, conservation, renewable energy, affordable housing, healthcare and education but it can be anything which works to bring about positive change.

A Rising Sector

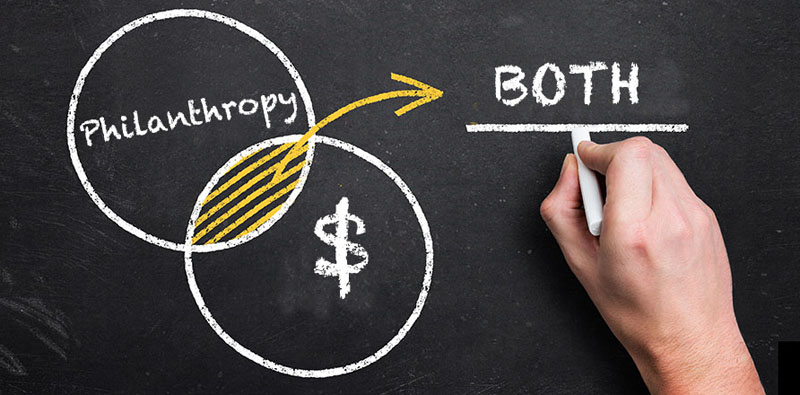

Impact investments are on the rise which is excellent news as it challenges the archaic view that market investments should solely focus on financial returns and social and environmental issues should be left to philanthropic donations. There are an increasing number of both large and small investors getting involved and even trillion dollar fund manager Wellington Management has a Global Impact Investment Fund as well as a Strategic Climate Science Initiative. This proves that there is money to be made in creating a better world and now is the time to take action.

Key Factors

The key with impact investments and what separates it from socially responsible investing is the fact that impact investments must measure and demonstrate the non-financial impact that they have. Therefore, this type of investment is perfect for those that are looking to protect and grow their assets while simultaneously using capital to make positive social and/or environmental change that can be measured. This also differs from ethical investments where certain ethical values are attached – this involves avoiding areas, such as tobacco. Impact investing considers the positive and negative impact of the investment so it could involve using funds in a controversial investment provided that they are making positive changes to their approach.

Millennials

Impact investment is undergoing a boom right now and it is easy to see this continuing. This is, partly, due to the rising group of eco-conscious Millennial investors with 52% of these seeing social responsibility of their investments being an important selection criteria. When this is combined with the current economic, social and environmental issues happening all around the world, it is easy to see more and more investors turning to impact investing in the near future.

Some are hesitant as they believe that you have to sacrifice financial returns to make a positive change, but this is not necessarily true. Much like any investment, some will fail to meet targeted returns while some will exceed and it is best to seek advice to find the best opportunities.

The surge in impact investing is welcome in a time where there are many issues around the world which need immediate attention. This will be a market that grows rapidly over the coming years and, if you invest intelligently, you could see great returns in addition to making a positive change.

Sources: bbc.co.uk / apple.com

Related Posts

« Effective methods for managing departmental budgets How to make your business stand out from the crowd »