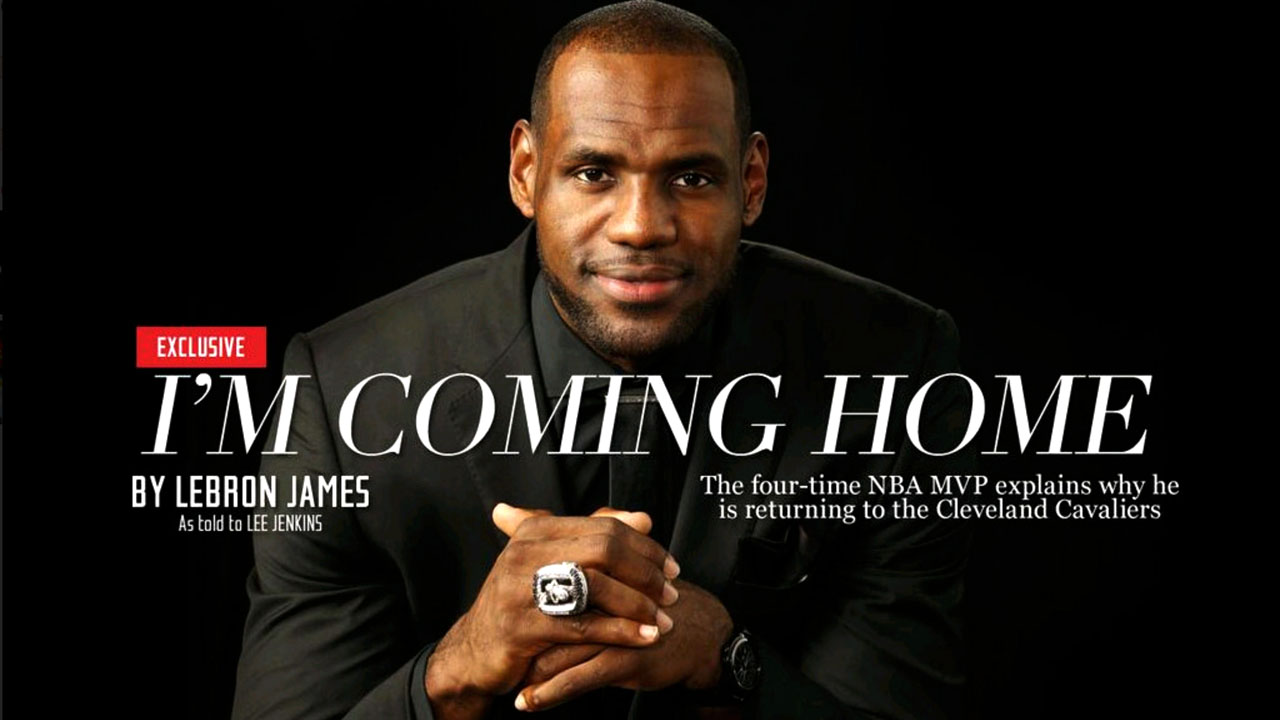

Last Friday the 11th of July, in an interview granted to Sports Illustrated, LeBron James decided to announce to the World that he had decided to leave the Miami Heat and make his return to the Cleveland Cavaliers. The news came out like a bomb and caught a lot of people in the United States and in the NBA by surprise, as LeBron James justified his choice with the fact that unlike what had happened in previous occasions, this time he prioritized his new contract and salary benefits.

After having won the NBA championship in 2 consecutive years for the Miami Heat (2012 and 2013), LeBron James and his teammates saw the San Antonio Spurs clinching the title earlier this year, which whether we want to admit it or not, may also have weighed in King James‘ decision.

After having worn the number 23 on the back of his jersey during his first spell with the Cleveland Cavaliers (2003-2010), LeBron James then switched off to the number 6 when he moved on to Florida to play for the Miami Heat. In his return to Ohio, the best basketball player of his generation has picked the number 32 for his new Cleveland Cavaliers jersey.

By opting out of his contract with the Miami Heat and signing this new contract with the Cleveland Cavaliers, Lebron James will earn a yearly salary of $21.050.000 US dollars. Since the 29-year old player actually signed a 2-year contract, the deal is actually worth a total sum around the 42.1 million US dollars.

Without further delay, here are all the details about Lebron James new contract and salary with the Cleveland Cavaliers, for both the 2014-2015 and the 2015-2016 season.

Lebron James salary and contract details: 2014-2016

- 2-year deal (from 2014-2016) worth a total gross salary of: 42.1 million US dollars

- Gross salary per year: 21.05 million US dollars

- Gross salary per game (based on Lebron‘s career average of 77 games per season): $273.377 US dollars

- Taxes owed to Ohio and Cleveland alone: 5.925% + 2% = 7.925%

Sources: taxfoundation.org / usatoday.com / si.com

Related Posts

« Big bet on US and UK equities Advantages of a Tax Haven for Your Business and Your Family »