It has generated a lot of controversy over the past few weeks and it seems like the 75% tax over high incomes in France is ready to be unrolled for a period of 2 years, starting in 2014. The guaranty was given by the French minister of Economy and Finance Pierre Moscovici, in an interview granted to a French economic newspaper called “Les Echos“.

This special tax will be charged over part of the income above one million euros (a measure which François Hollande used on his favor during his presidential campaign) and it has been added into the country’s state budget for 2013, as it is expected to take effect over the next two years.

This measure has actually already been rejected by the French Constitutional Council, who has ruled that the tax in question infringes the principle of equality before public charges. Following that decision, the French Government was forced to reframe a few details concerning the way this tax will be applied. One of the main changes had to do precisely with the entity responsible for the tax payment, which will now be the French companies. The minimum income remains being one million euros though.

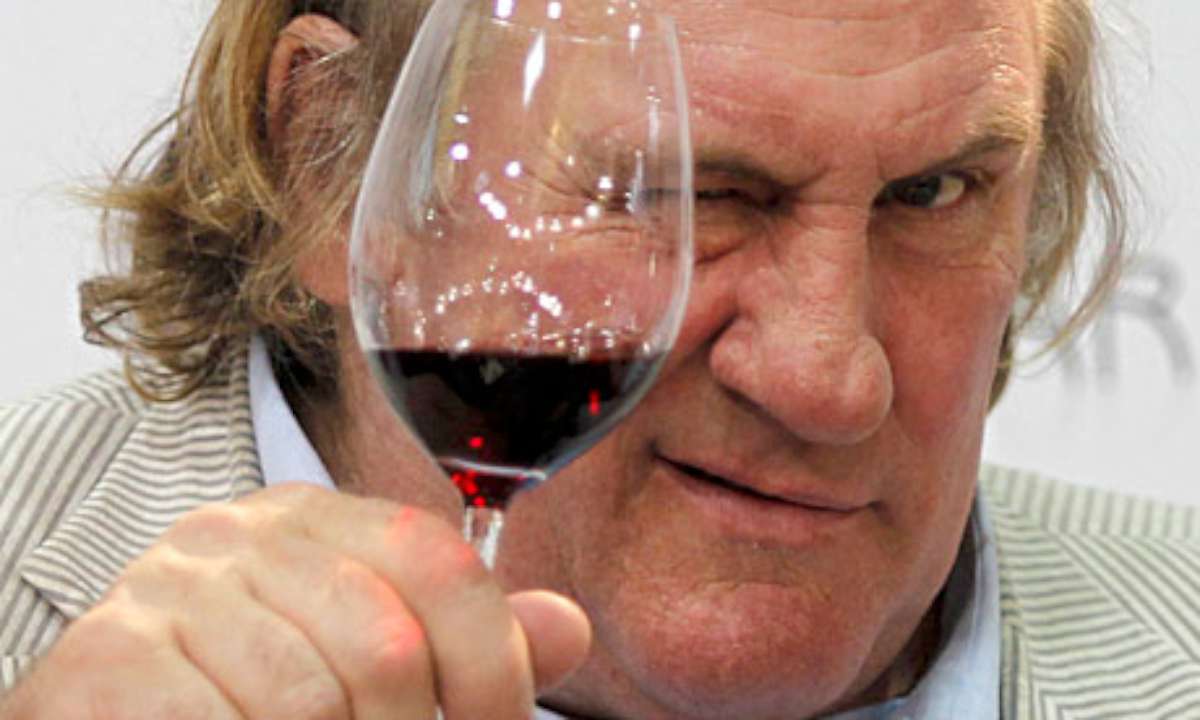

This tax was presented by the French prime-minister François Hollande, as a solution to redistribute the sacrifices, in times where budget constraints are in the order of the day. The measure itself wasn’t obviously taken with a big smile by everyone in France, especially amongst the enterpreneurs and businessmen affected by it, as it was the case of the French actor Gérard Depardieu, who already decided to switch his residence to Belgium.

Sources: publico.pt

Related Posts

« One less tax haven: Andorra plans to implement income tax Facebook headquarters to move to New York’s downtown »